tax strategies for high income earners australia

For income levels between. And through proactive tax planning we ended up saving him over 35000 in tax keeping his average tax rate on the business income less than 20.

![]()

Disparity In Income Distribution In The Us Deloitte Insights

Our top tax planning strategies come in three main focus areas and these should be discussed with a qualified and experienced tax accountant.

. For comparison the contribution and benefit base in 2022 was 147000. 10 There are several types of taxes. Investment earnings are taxed at the corporate tax rate of.

If you are a high-income earner it is sensible to implement tax minimisation strategies. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected. For high-income earners this would lead to a significant tax reduction.

Division 293 tax is an extra charge imposed on some of the super. This is an important strategy. Invest in Qualified Opportunity Zones.

This article lists seven strategies you should consider. In 2021 the employee pre-tax contribution limit for 401k and 403b plans is 19500. Tax Reduction Strategies For High Income Earners Australia.

Trusts can also help reduce your state income tax liability on investment earnings so while the Federal tax rate stays the same there are savings on state taxes. Qualified charitable distributions qcd 4. How Much Does A High Income Earner Earn In Australia.

Donate More to Charity. Trusts can also help reduce state taxes on investment earnings. Tax strategies for high income earners australia.

If your earned income is 160200 or greater in 2023 the maximum Social Security tax is 993240. The tax benefit of salary sacrifice super contributions is now more significant with the higher individual tax rates. However while there are no limits to the amount of salary you can sacrifice unless specified in your terms of.

As you consider tax strategies for high-income earners its important to remember that your income tax is determined by how large your net taxable income is in any given year. Structure Structure Structure Timing is key. One of the most popular tax-saving strategies for high-income earners involves charitable contributions.

The federal income tax is designed to tax higher levels of income at higher tax rates. Implementing tax minimisation strategies is crucial for high-income earners. Take Home Rates for an annual income of 400000.

There are several income-splitting strategies that families can use to reduce their tax burden. For taxable income levels between 180000 and 273000 the tax. Effective tax planning with a qualified accountanttax specialist can help you to do.

One of the most common tax-minimization strategies high net worth people use is one to which people of all income levels. Under RS rules you can deduct charitable.

Calling All Retiring Types Make Sure Your Superannuation Fund Stays Super South China Morning Post

Us Super Rich Pay Almost No Income Tax Bbc News

5 Tax Deductions For High Earners Plus A Tax Hack The Physician Philosopher

4 High Income Earner Tax Strategies

Income Inequality Our World In Data

9 Ways For High Earners To Reduce Taxable Income 2022

![]()

Tax Strategies Corporations And Trusts The Live Life Project

How Scandinavian Countries Pay For Their Government Spending

Tax Reduction Strategies For High Income Earners 2022

Is Australia S Tax And Welfare System Too Progressive Inside Story

The Student Loan Forgiveness Loophole For High Income Earners

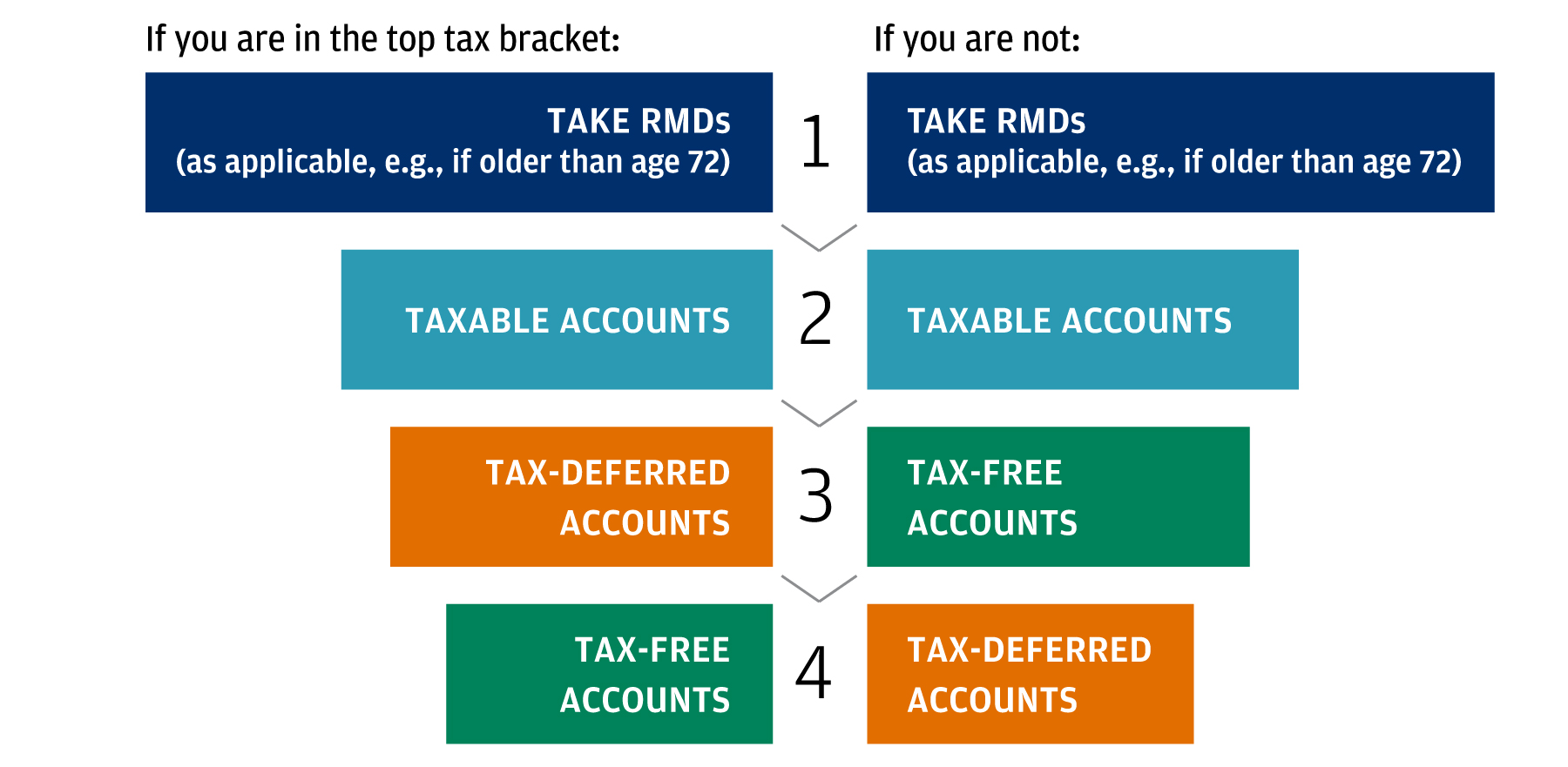

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

Tax Saving Strategies For High Income Earners Smartasset

How Can 7 Figure Income Earners Save On Income Taxes Quora

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

Taxing The Rich The New York Times

Australian Income Tax Brackets And Rates 2021 22 And 2022 23